At Mintyn, we understand the unique financial needs of businesses, regardless of their size or industry. Our commitment to supporting businesses is unwavering, and our Business Account is designed to be just what your business needs.

Doesn’t matter if you are a budding entrepreneur or a business magnate, a Mintyn business account provides personalised financial solutions, so no customer is left behind! Some resources and support features available on our business account include:

I. Tax Identification Number (TIN) Application & Tax Advisory Services

II. Corporate Affairs Commission (CAC) Registration

III. Business Loans

IV. Automated Payroll Services with PayStream

V. Budgeting and Expense Tracking with CoinBuddy and SpendMapster

We don’t just provide services; we offer convenience, security and accessibility, all wrapped into one tailored package. Your business deserves a financial partner that eases the burden and allows you to focus on your growth and success.

Make us your trusted financial partner. Open a business account with Mintyn today!

We Know Your Business Needs

Regardless of size, whether it’s a small startup or an established enterprise, certain fundamental financial requirements remain consistent across all businesses.

These fundamental requirements are that businesses must receive payments, make payments, manage payroll, source funding, and plan for future investments. The challenge lies in finding efficient and secure ways to meet these needs.

This is where a tailored business account becomes essential. A one-size-fits-all approach in banking simply doesn’t work for businesses. Each business has its unique financial DNA, and its bank must be able to adapt to it.

A generic personal account won’t suffice either. Instead, a business needs specialised services, such as advanced payment processing, accounting integrations, and financial advisors, all under one roof.

At Mintyn, we understand the complex and diverse financial needs of businesses. We are committed to providing tailored solutions that empower businesses to succeed, regardless of size or complexity. As your financial partner, we aim to simplify your financial journey by supporting you with the right tools and resources.

The Mintyn Business Account Advantage

Our business account is designed to deliver a comprehensive set of features and benefits that cater specifically to the diverse financial needs of businesses. Here’s why choosing Mintyn for your business banking needs is a decision that can redefine your financial success.

Tailored Financial Solutions for Your Business

No two businesses are alike, which is why we don’t offer one-size-fits-all solutions. Our business account is designed to be as unique as your business is, offering various features to address your specific financial requirements.

1. Streamlined Online Transactions: Simplify your business transactions with our user-friendly web and mobile banking apps. Perform deposits, transfers, and bill payments effortlessly from the comfort of your office or on the go.

2. Efficient Payment Processing: Whether it’s processing payments to vendors, receiving payments from clients, or managing your payroll, we’ve got you covered. Say goodbye to payment delays and hassles.

3. Financial Management Tools: Gain insights and control over your finances with our advanced financial management tools. Monitor your cash flow, track expenses, and plan for future investments easily.

4. A Business Account With Your Brand Name: We believe your brand identity is one of your valuable assets, and your business bank account should reflect that. We’ll get you a business bank account that bears your business name.

CoinBuddy and SpendMapster are specially designed to help you plan and monitor your finances. You will find our PayStream to be an invaluable tool for employee payroll management. EasyCollect helps you receive payments from vendors without any hassle.

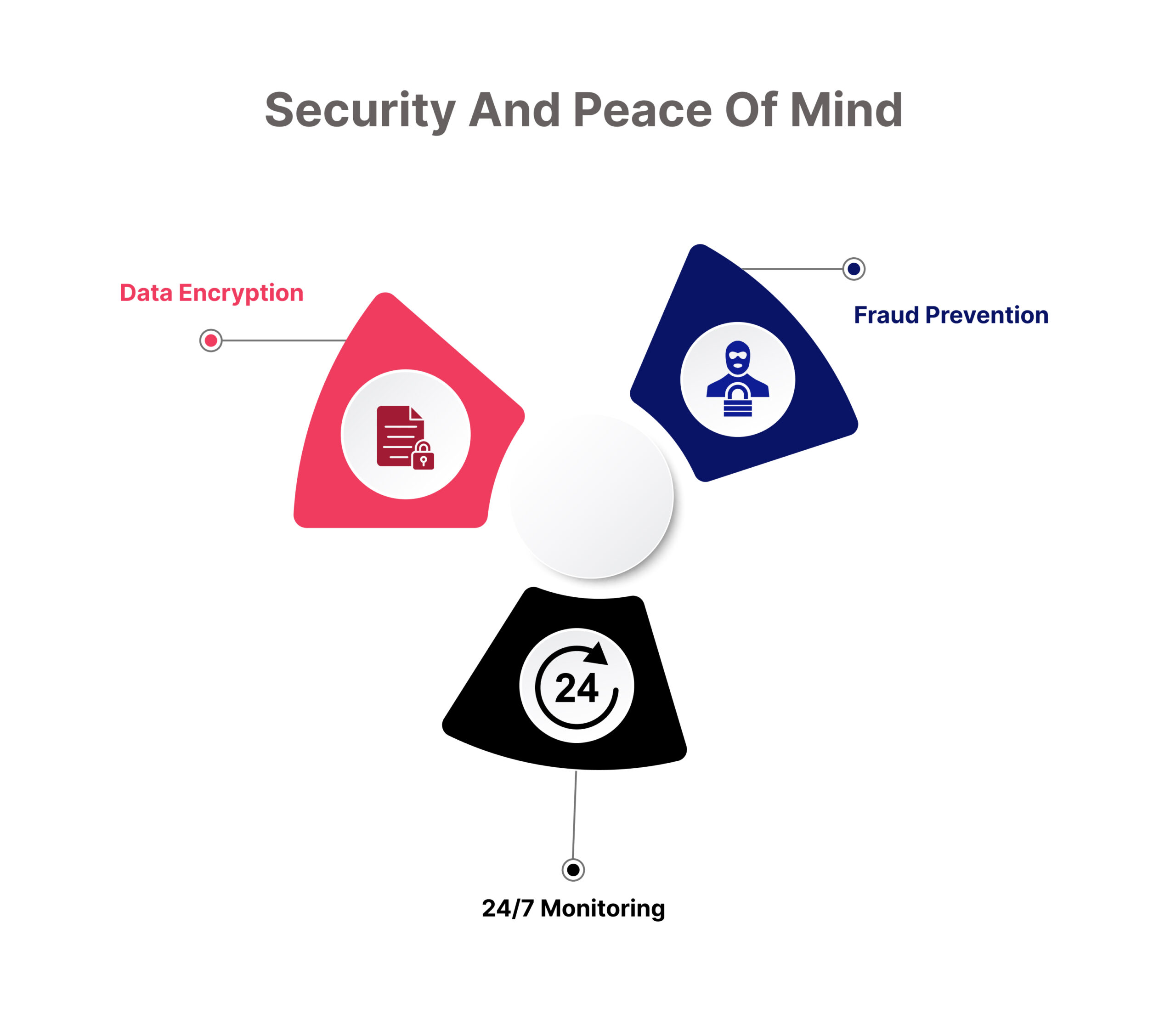

Security and Peace of Mind

We understand that security is paramount in business transactions. Our state-of-the-art security measures protect your financial data from any potential threats. With Mintyn, your business finances are in safe hands.

1. Data Encryption: Our advanced encryption technology safeguards your online transactions and financial data.

2. Fraud Prevention: We employ robust fraud prevention systems to protect your accounts from unauthorised access.

3. 24/7 Monitoring: Our dedicated team is vigilant round the clock, ensuring the security of your accounts.

Real Business Success Stories

But don’t just take our word for it. Here are some success stories from businesses that have entrusted their financial future to Mintyn:

Amaka’s ThriftWears: “Switching to Mintyn was a game-changer for my boutique. The online payment processing and financial management tools have made my life much easier. Now I can focus on my customers, knowing my finances are in good hands.”

JudeGraphics Ltd: “As a tech startup, we needed a bank that could keep up with our pace. Mintyn not only met our online transaction needs but also provided invaluable financial advice. We’ve seen significant growth since making the switch.”

Iya Ayo Cold Stores: “The security of my funds is my top priority. Mintyn gives me the peace of mind I need, knowing that my money is safe. Plus, their payment processing has significantly improved my cash flow.”

Choosing Mintyn for your business banking means equipping your business with the tools and support it needs to thrive.

Discover the Mityn Business Account Advantage and experience the difference for yourself. Open a Mintyn Business Account today!

A Mintyn Business Account offers Competitive Pricing and Cost Savings

In business, every penny counts. We recognise the importance of cost-effectiveness, and that’s why the Mintyn Business Account is built with competitive pricing and cost savings in mind. Save costs, maximise profits! Open a Mintyn Business Account today!

Transparent and Competitive Pricing

With Mintyn, you’ll never encounter hidden fees or surprises in your statements! We believe in transparent and straightforward pricing structures. We’re committed to offering some of the most competitive rates in the industry, ensuring that your business gets the most value for its money.

Fee-Free Transactions

Transactions are a part of daily life. Many banks burden businesses with a lot of transaction fees, but not us. Mintyn is proud to offer a range of fee-free transactions, from incoming payments to transfers and bill payments. This means that your hard-earned money stays where it belongs – in your business accounts!

Say goodbye to unnecessary fees, switch to the Mintyn business account now!

Reduced Overhead Costs

Minimising overhead costs is critical for businesses of all sizes. Our streamlined online platform, along with efficient payment processing and financial management tools( EasyCollect, SpendMapster, CoinBuddy and PayStream), helps reduce operational costs.

Spend less time on administrative tasks and more time growing your business!

Savings in the Long Run

Choosing Mintyn for your business banking isn’t just a short-term gain; it’s an investment in your business’s financial future. With reduced fees, cost-effective solutions, high interest rates and simplified financial management, your savings accumulate over time, giving you a strong foundation for long-term business growth.

When you choose Mintyn for your business banking, you’re not just opening an account; you’re investing in your business’s financial well-being. Every penny saved is a step closer to your business’s success.

How to Open a Mintyn Business Account

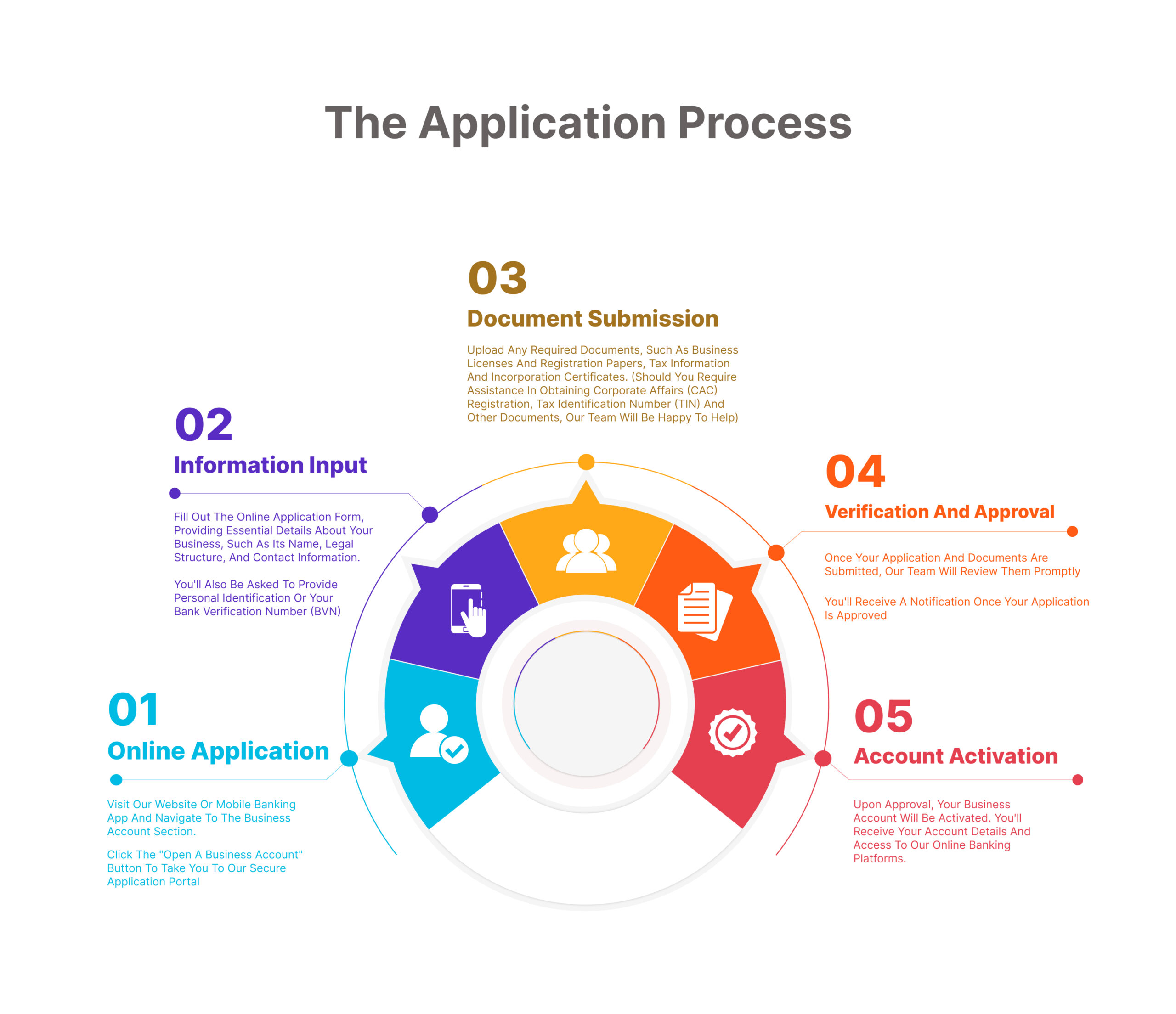

The Application Process

We understand that your time is valuable, and we’ve designed our application process to be as simple and efficient as possible, ensuring you can start benefiting from our business accounts without any unnecessary delays.

1. Online Application

Visit our website or mobile banking app and navigate to the Business Account section.

Click the “Open a business account” button to access our secure application portal.

2. Information Input

Fill out the online application form, providing essential details about your business, such as its name, legal structure, and contact information.

You’ll need to provide personal identification or your Bank Verification Number (BVN)

3. Document Submission

Upload any required documents, such as business licenses and registration papers, tax information and incorporation certificates.

(Should you require assistance in obtaining Corporate Affairs (CAC) Registration, Tax Identification Number (TIN) and other documents, our team will be happy to help.)

4. Verification and Approval

Once you submit your application and documents, our team will review them promptly. You’ll receive a notification upon the approval of your application.

5. Account Activation

Upon approval, your business account will be activated. You’ll receive your account details and access to our online banking platforms.

Our process allows for speed and simplicity, ensuring you can quickly access the benefits of our business account. We’re here to support you at every step, making the transition to Mintyn a smooth and hassle-free experience.

An Environmentally Friendly Business Account with Mintyn

A Mintyn business account is where the future of banking meets environmental responsibility. Embracing digital banking goes beyond the convenience of managing your finances; it’s a step towards a greener, more sustainable future.

Mintyn contributes to environmental responsibility by reducing paper usage and minimising your carbon footprint.

Environmental Responsibility

Reduced Paper Usage

In our commitment to environmental responsibility, we’ve significantly reduced the need for paper in your financial transactions. Traditional banking often involves countless sheets of paper for statements, receipts, and documentation. In contrast, Mintyn offers a paperless approach that helps conserve valuable resources.

By opting for our digital business account, you play a part in reducing paper production, ultimately saving trees and minimising the environmental impact of paper manufacturing. Say goodbye to physical statements and hello to the convenience of accessing your financial information digitally.

Minimised Carbon Footprint

Every action counts in combating climate change. Traditional banking practices, with their reliance on paper and needing customers to commute to bank branches, have a considerable carbon footprint. In contrast, digital banking is a game-changer in minimising this impact.

When you choose our business bank account, you choose a bank that cares about the environment.

By conducting your financial transactions online, you reduce the need to travel to physical branches, which means fewer cars on the road, less fuel consumption, and reduced greenhouse gas emissions.

In other words, it’s not just your financial burden that gets lighter; it’s the environmental burden as well!

How Does Mintyn Make a Difference?

Paperless Statements: Access your account statements, transaction histories, and documents digitally. No more cluttered file cabinets or stacks of paper. Our digital platform lets you securely view, download, and store your financial records.

E-statements: Receive your account statements through secure electronic delivery. Not only do you get quick access to your financial information, but you also help save trees and reduce paper waste.

Online Banking Tools: Our online banking tools, like checking balances and reviewing transactions, promote a greener banking experience. With these features, you can manage your finances efficiently without needing printed documents.

Reduced Travel: With our mobile app and online banking, you can conduct your banking activities from the comfort of your home. There’s no need for frequent visits to a physical branch, cutting down on your carbon emissions and contributing to a cleaner environment.

Join Us in Making a Difference! Start banking with Mintyn today!

Explore our other bank account offerings.