Businesses need integrated financial solutions to remain relevant. Mintyn offers Banking as a Service(BaaS) and embedded financial solutions to integrate with your business operations seamlessly no matter the size. By taking advantage of Mintyn’s APIs, businesses can enhance their financial operations and improve business efficiency.

Mintyn Banking as a Service and Embedded Finance solutions

Mintyn Banking as a Service(BaaS)

Mintyn’s Banking as a Service (BaaS) is a financial solution that allows businesses to offer financial products or services directly through their platforms and user experience using our APIs. Baas enables businesses to integrate important financial services, such as payments, loans, and account management, without building a full banking infrastructure.

Embedded Finance

Embedded finance, on the other hand, refers to integrating these financial services into non-financial platforms and applications. This means financial functionalities are integrated into the user experience of non-financial services, like e-commerce websites, ride-booking services, or food-buying apps.

As an illustration, with Mintyn’s embedded finance solutions, a food-buying app can offer in-app payments with various payment options. An online store can provide instant credit options at checkout, making financial transactions more convenient and enhancing the overall user experience.

Combined Benefits

Mintyn’s BaaS and Embedded finance solutions work hand in hand to improve business transactions, making it easier for companies to offer integrated financial and improve their operating efficiency.

What sets Mintyn Apart from other BaaS and Embedded Finance?

When choosing banking as a service(BaaS) or Embedded finance provider, it’s important to know what sets each one of them apart. Here are some features that make Mintyn a standout BaaS choice for businesses;

Robust Integration abilities

Mintyn’s API ensures integration with businesses’ existing systems to ensure a secure flow of their financial data. Compared to other BaaS and Embedded finance companies that may require businesses to rebuild their ongoing system, Mintyn BaaS adapts to businesses’ needs to provide a flexible integration process.

Customization

Your business is unique, and your financial solution is also. Mintyn offers various customization levels, allowing you to tailor our services to match your business requirements. Our customisation guarantees you whether your business needs a specialised workflow, reporting features, or any unique integrations. Mintyn’s customisation options ensure you get a solution designed precisely for your business.

Scalability for all Business Sizes

Irrespective of your business size, Mintyn is willing to grow with you. Our banking as a service solution is scalable, ensuring it evolves with your business. Mintyn can scale its services as your financial needs expand to meet your business’s new demands and grow with your business.

Compliance and Security

Trust is paramount in finance. Mintyn strongly emphasises compliance with industry regulations and employs top-notch security measures to safeguard your financial data.

Mintyn’s Banking as a Service is more than a service; it’s a strategic partnership designed to optimise your financial processes and elevate your business to new heights. Ready to explore the future of banking?

No Hidden Fees Pricing

Mintyn believes in transparency when it comes to our prices. Therefore, we offer clear pricing plans with no hidden cost to ensure you know what you are paying for. This clarity we operate with sets us apart from competitors. Experience the Mintyn advantage today and discover how our unique features can benefit your business. Contact Us

Mintyn’s Banking as a Service In Simpler Terms

Mintyn’s Banking as a Service (BaaS) is a convenient financial toolbox for your business. This toolbox is also known as “Embedded Finance,” which is like embedding financial tools into the core of your business operations.

With this, you do not have to use different systems for banking, managing your money, or keeping track of inventory. With Mintyn Banking as a service, you can access this service together in one place.

This is made possible with our API(Application Programming interface).

What is an API? Think of an API as a smart assistant in your office who can communicate with all departments: finance, customer service, inventory, and more. Tell your smart assistant(API) what you want when you need information. The assistant goes to the relevant department(service or database), gets the information or service, and brings it back to you quickly and accurately.

In this case, Mintyn’s BaaS uses APIs to seamlessly integrate banking, financial, and inventory management services directly into the day-to-day operations of a business. This means Mintyn’s BaaS makes handling money and keeping track of inventory easier for businesses. It’s like having an efficient financial assistant that takes care of everything in one go.

Some of Mintyn’s Banking as a Service Solutions

1. Virtual Accounts

A virtual account is like a temporary online bank account that handles transactions for a real bank account, helping businesses collect payments and manage accounts easily.

Multiple virtual accounts may be created to receive payments separately for direct transfer to the real account they serve. However, unlike a regular bank account, a virtual account automatically keeps track of all customer payments made through bank transfers in a smarter way.

2. Payment Processing

Embedded Payment Gateways: Integrated payment solutions within apps, websites, or platforms.

In-app Payments: Enabling users to make transactions without leaving the application.

Subscription Billing Services: Automated billing and subscription management are embedded in applications.

3. Digital Wallets

In-app Digital Wallets: Integrated digital wallets allow users to store, manage, and use funds within the application.

P2P Transfers: Facilitating peer-to-peer fund transfers within apps.

4. BNPL (Buy Now, Pay Later)

Embedded BNPL Solutions: Integrating installment payment options directly into the checkout process of e-commerce platforms.

5. APIs and SDKs

Financial APIs: Providing developers with interfaces to connect applications to financial services.

SDKs for Financial Integration: Software development kits to embed financial functionalities seamlessly.

6. Expense Management

Integrated Expense Tracking: Tools within non-financial apps for tracking and managing expenses.

Automated Receipt Capture: Features that automatically capture and organize receipts for better expense management.

7. Lending Solutions

Embedded Loans: Providing users with access to loans directly within non-financial applications.

Credit Scoring APIs: Integration of credit scoring services for instant loan approvals.

8. Insurance Integration

In-app Insurance Purchases: Users can buy and manage insurance policies within other applications.

Claims Processing APIs: Integrating insurance claims processing directly into relevant platforms.

9. Financial Analytics

Embedded Financial Analytics: Giving users insights into their financial data directly within applications.

Budgeting Tools: Features that help users set and manage budgets within non-financial apps.

10. Cross-Border Payments

Integrated Forex Services: Facilitating seamless international transactions and currency conversions within applications. Receive or make payments in foreign currencies.

11. KYC (Know Your Customer)/Identity Verification Services

Embedded KYC Solutions: Verifying user identities within apps for compliance and security.

12. Savings and Investments

Embedded Investment Platforms: Allowing users to invest and manage portfolios within non-financial applications.

Automated Savings Tools: Features that help users save money automatically within apps. These embedded finance solutions contribute to the growing trend of creating a unified and easy user experience by incorporating financial services into various non-financial platforms. Reach out to us to get started. Contact Us

Benefits of Mintyn’s Banking as a Service

Cost Efficiency

Mintyn’s Banking as a Service is not just a cost-effective solution; it’s a smart investment for your business. By streamlining financial processes and reducing manual workload, we help you cut down on operational costs. Whereby you do not have to worry about unnecessary expenses and you can have an efficient, budget-friendly approach to banking.

Time Savings

Time is money, and Mintyn understands the value of both. With our Banking as a Service, tedious financial tasks will no longer take up your time. We will help you automate processes, handle transactions, and give you more time to focus on growing your business.

Enhanced Customer Experience

Happy customers are the backbone of any successful business. Mintyn’s Banking as a Service goes beyond the numbers; it’s about creating a positive customer experience. With our user-friendly interface and efficient payment solutions, we contribute to a seamless customer journey, fostering loyalty and satisfaction.

Regulatory Compliance

Regarding finance, compliance is non-negotiable, and Mintyn takes this seriously. Our Banking as a Service is designed to adhere to regulatory standards, ensuring your business operates within the legal framework. You can rely on Mintyn for a secure and compliant financial operation.

How Mintyn’s Banking as a Service Can Boost Your Business

Mintyn’s Banking as a Service is an invaluable asset for anything related to commerce. Our APIs seamlessly integrate with your platforms to facilitate secure and swift transactions.

Our real-time data analytics provide insights into sales trends, customer behaviors, and inventory management.

With Mintyn, your business gains a competitive edge, ensuring a smooth financial experience.

1. Point of Sale (POS) Integration

Example: A boutique clothing store can seamlessly integrate Mintyn’s Banking as a Service with its POS system. This integration enables real-time tracking of sales, inventory, and customer transactions. The result is an efficient retail experience where the store can manage stock levels, process payments, and analyze customer purchasing behavior effortlessly.

Mintyn’s Banking as a Service integration with the store is powered by Mintyn’s easy collect, virtual account, and payment processing solutions, which improved the store’s retail experience.

2. Inventory Management

Challenge: A chain of electronic stores finds it hard to manage inventory across multiple locations, leading to overstock situations and increased holding costs.

Solution: By embedding Mintyn in the store’s inventory, they could gain insights into stock levels, trends, and product performance.

The Result: Mintyn integration with the store ensured optimal stock levels and reduced overstock situations. Enabling the store to predict demands and data-driven purchasing decisions now.

3. Customer Loyalty Programmes

Example: A supermarket franchise can utilize Mintyn’s Banking as a Service to enhance its customer loyalty program. Integrated with the payment system, Mintyn allows the business to track and reward customer purchases seamlessly.

This fosters customer loyalty, as patrons enjoy a hassle-free and rewarding experience every time they make a purchase.

4. e-Commerce Integration

Example: An electronic retailer with an online presence can benefit from Mintyn’s Banking as a Service by integrating it with its e-commerce platform. Mintyn facilitates secure online transactions, tracks order fulfillment, and provides real-time analytics.

It leads to a smooth online shopping experience for customers, increased sales, and allows the retailer to optimize its online operations.

5. Expense Management

Example: A chain of convenience stores can use Mintyn’s Banking as a Service to simplify expense management. Mintyn can track and manage each store’s expenses centrally, providing a comprehensive view of operational costs.

This centralised approach enables the business to identify cost-saving opportunities and improve overall financial efficiency.

How Mintyn’s Banking as a Service Helps Industries

No two industries are alike, and neither are their financial challenges. Different industries face unique financial challenges. Mintyn understands this diversity and provides tailored solutions to address industry-specific pain points.

Mintyn adapts to the system of your sector, offering a customised approach to financial management. Here’s how Mintyn can support different industries.

1. Hospitality

Mintyn’s Banking as a Service provides a tailored financial solution for the hospitality industry, streamlining payment processes, managing reservations, and optimising financial transactions.

Hotels, restaurants, and event venues can benefit from Mintyn’s seamless integration, ensuring a hassle-free experience for both businesses and their patrons.

2. Healthcare Finance

Financial management is crucial for providing quality patient care in the healthcare sector.

Challenge: A private hospital finds it difficult to manage medical billings, insurance claims, and financial transactions, which impacts the quality of care to patients.

How we help: Mintyn’s Banking as a Service offers a secure and compliant platform for the hospital to simplify these processes.

The result of Mintyn’s BaaS: It improved cash flow, reduced administrative burden, and enhanced overall financial performance.

3. Manufacturing

Mintyn’s Banking as a Service offers robust tools for managing complex financial workflows in manufacturing. From supply chain transactions to payroll management, Mintyn provides a centralised platform to track and optimise financial processes.

Manufacturers can enhance efficiency, reduce costs, and gain valuable insights into their financial performance.

4. Real Estate

Real estate transactions involve complicated financial processes. Mintyn’s Banking as a Service simplifies property transactions, rent collection, and financial reporting for real estate businesses.

By providing a secure and transparent financial platform, Mintyn facilitates smoother real estate operations, whether property management, leasing, or sales.

5. Education

Educational institutions, from schools to universities, can leverage Mintyn’s Banking as a Service for efficient financial management. Tuition payments, payroll processing, and budget tracking become seamless with Mintyn’s integrated solutions.

This ensures educational institutions can focus on their core mission of providing quality education.

6. Non-Profit Organizations

For non-profit organisations, financial transparency and accountability are paramount. Mintyn’s Banking as a Service offers a solution for managing donations, grants, and overall financial operations.

With features like real-time reporting, non-profits can efficiently allocate resources, track expenditures, and maintain compliance with financial regulations.

7. Fintech Startups

For fintech startups, agility and adaptability are key. Mintyn’s Banking as a Service is crafted with the dynamic needs of startups in mind.

Here is an insight into how Mintyn BaaS can help your startup

Challenge: A fintech needs adaptable financial solutions to support its growth and innovation.

How we help: Mintyn’s Banking offers scalable solutions for payment processing, user account management, and regulatory compliance.

The result of Mintyn’s BaaS: The startup can focus on innovation as our financial solution grows with the business. Which led to successful market penetration, operations, and compliance with industry regulations.

8. Transportation and Logistics

Mintyn’s Banking as a Service optimises financial processes in transportation and logistics. From managing fuel expenses to tracking shipment payments, Mintyn provides a comprehensive solution. This allows businesses in the transportation and logistics sector to enhance financial visibility and streamline operations.

Mintyn’s Banking as a Service optimises financial processes in transportation and logistics. From managing fuel expenses to tracking shipment payments, Mintyn provides a comprehensive solution. This allows businesses in the transportation and logistics sector to enhance financial visibility and streamline operations.

9. Agriculture

Agricultural businesses can benefit from Mintyn’s Banking as a Service by managing farm expenses, handling transactions with suppliers and distributors, and tracking revenue from crop sales. Mintyn’s customisable features adapt to the unique financial needs of agricultural enterprises, contributing to improved financial management.

Mintyn’s Banking as a Service is designed to cater to the diverse financial needs of businesses across a wide range of industries. Whether optimising transactions, managing payroll, or enhancing overall financial visibility, Mintyn is a versatile partner committed to driving financial success in various sectors.

Tailor Mintyn Banking as a Service solution to your industry needs. Contact us today to discover how we can customize our services for your business. Contact Us

How Mintyn Works

Mintyn BaaS is designed with ease of use and flexible integration in mind. Here’s how Mintyn works from onboarding to user interface.

Onboarding Process

Your journey with Mintyn begins with a seamless onboarding process designed for simplicity and efficiency. We understand that time is of the essence, and our onboarding is crafted to get you up and running swiftly.

You will be guided step-by-step through a user-friendly interface to set up your Mintyn account. From inputting basic information to customising your preferences, we make the onboarding process intuitive, ensuring that you can start leveraging Mintyn’s Banking as a Service solutions in no time.

During onboarding, you will have the opportunity to tailor Mintyn to your industry’s specific needs. Whether you’re in retail, manufacturing, healthcare, or any other sector, Mintyn adapts to your requirements.

Our support team can assist and ensure a smooth onboarding experience. Once completed, you will gain access to a powerful financial toolkit designed to improve your operations and drive success in your industry.

Integration

Mintyn’s strength lies in its ability to seamlessly integrate with your existing systems, creating a unified ecosystem for your financial operations. Our robust API connections facilitate smooth integration, allowing Mintyn to work harmoniously with your current software and processes.

Whether using accounting software, POS systems, or e-commerce platforms, Mintyn effortlessly becomes integral to your workflow. The integration process is designed with flexibility in mind. You choose the level of integration that suits your business needs, ensuring that Mintyn enhances rather than disrupts your current operations.

Our team of experts is available to guide you through the integration steps, providing assistance and insights to optimise the process. Once integrated, Mintyn synchronizes data in real time, providing you with up-to-the-minute insights into your finances. Say goodbye to manual data entry and hello to a smooth, automated approach that allows your business to operate at its full potential.

User Interface

Thanks to our intuitive and user-friendly interface. The dashboard is designed with simplicity and functionality, providing a centralised hub for all your financial and operational activities. From tracking transactions to analysing performance metrics, Mintyn’s user interface offers a comprehensive view of your business landscape.

Customisation is key, and Mintyn’s user interface allows you to tailor your dashboard to display the information most relevant to your industry and business goals. The result is an interface that adapts to your workflow, making financial management a straightforward and efficient process.

Our commitment to user experience extends beyond aesthetics. We prioritise accessibility and responsiveness, ensuring that Mintyn’s interface is easy to navigate on various devices. Whether at your desk or using a mobile device, Mintyn provides a seamless user experience that puts control at your fingertips.

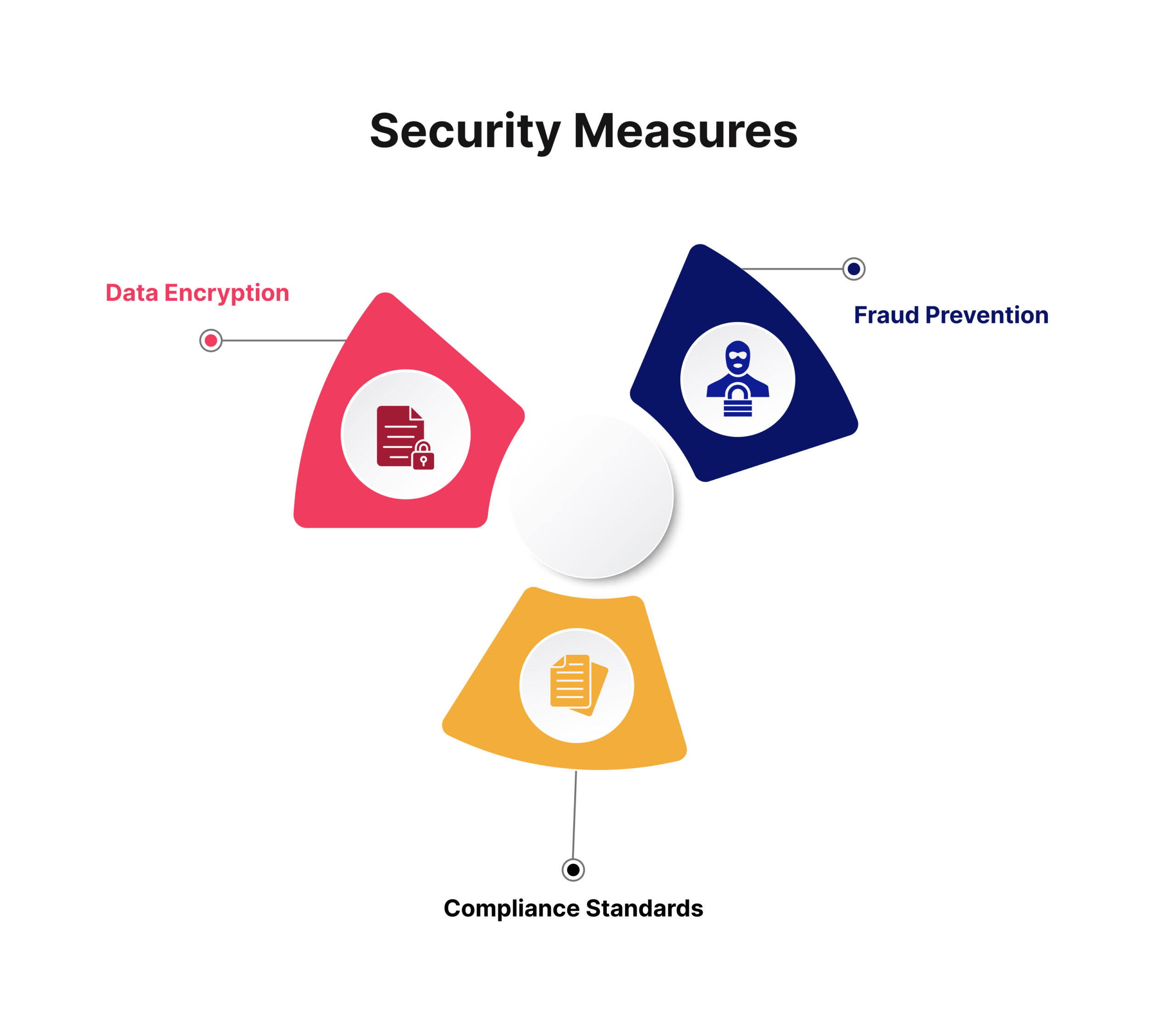

Security Measures

Data Encryption

At Mintyn, safeguarding your financial data is our top priority. We employ cutting-edge data encryption measures to ensure the confidentiality and integrity of your information.

Using industry-standard encryption protocols, we secure your data both in transit and at rest. This means that your data remains shielded from unauthorised access, whether you’re processing transactions, accessing reports, or managing your account.

Our encryption technology adheres to the highest security standards, employing robust algorithms to encrypt and decrypt sensitive information. With Mintyn, you can trust that your financial data is fortified against potential threats, providing you with peace of mind.

Fraud Prevention

Mintyn takes a proactive stance against fraud, implementing comprehensive measures to prevent unauthorised activities and protect your financial assets. Our fraud prevention mechanisms leverage advanced algorithms and machine learning to detect irregular patterns and transaction inconsistency.

Real-time monitoring is a cornerstone of our fraud prevention strategy. Mintyn’s system continuously analyses transactional data, swiftly identifying any suspicious activities.

Our system triggers alerts in the event of potential fraud, allowing for immediate intervention and investigation. Additionally, Mintyn provides you with tools to customise and enhance your fraud prevention settings.

You can set transaction limits, implement multi-factor authentication, and customise alerts to align with your business’s risk tolerance. With Mintyn, you receive a powerful financial management tool and a robust defense system against fraudulent activities.

Compliance Standards

Mintyn operates with a steadfast commitment to compliance with industry regulations and standards. Our Banking as a Service platform is designed to align with the stringent requirements of financial regulatory bodies, ensuring that your financial operations meet the highest standards of legality and ethical conduct.

We conduct regular audits and assessments to verify our compliance with industry-specific regulations. From data protection laws to financial reporting standards, Mintyn consistently upholds the rules governing your industry. This commitment safeguards your business from legal implications and contributes to building trust among stakeholders.

Choose Mintyn for a secure and compliant financial environment. Our dedication to data encryption, fraud prevention, and compliance standards sets the stage for a trustworthy partnership.

Pricing and Customisation

Transparent Pricing

Mintyn believes in transparency and simplicity when it comes to pricing. We understand that cost clarity is essential for businesses to make informed decisions. Our pricing plans are straightforward, with no hidden fees or surprises.

We believe in providing value for your investment, and our transparent pricing ensures that you know exactly what you’re paying for. Our pricing model accommodates businesses of all sizes, from startups to large enterprises. We offer tiered plans, each catering to specific needs and scales of operation.

Whether you’re a small business looking to streamline basic financial processes or a large enterprise requiring advanced features, Mintyn’s transparent pricing allows you to choose a plan that aligns perfectly with your requirements.

As part of our commitment to transparency, we provide detailed breakdowns of charges, ensuring that you clearly understand where your investment is going. We value your trust, and our transparent pricing reflects our dedication to fostering long-lasting partnerships with businesses across various industries.

Customisation Options

Recognizing that every business is unique, Mintyn goes beyond standardized offerings by providing robust customization options. Our goal is to tailor our services to meet your industry’s specific needs and preferences.

Whether you require additional features, specific integrations, or a personalised approach to financial management, Mintyn’s customisation options empower you to create a solution that fits your business like a glove.

Our platform allows you to customise workflows, reports, and user interfaces to align with your industry’s intricacies. Need specialized integrations with existing systems? No problem – Mintyn’s open architecture facilitates seamless customisation to ensure the platform integrates seamlessly into your operations.

Regarding pricing, our customisation options extend to accommodate your budgetary constraints. We understand that businesses have diverse financial structures, and Mintyn’s flexibility allows you to tailor your pricing plan to suit your financial capacity while still enjoying the full benefits of our Banking-as-a-service platform.

Choose Mintyn for a pricing experience that not only meets your financial expectations but also aligns perfectly with the unique requirements of your industry. Our transparent and customisable pricing reflects our commitment to providing value that evolves with your business.

Support Services

At Mintyn, we understand that ongoing support is crucial for a seamless financial experience. Our dedicated support services are designed to assist you with Mintyn’s Banking as a Service platform at every step of your journey.

Whether you have questions during the onboarding process, need assistance with customisation, or require help resolving an issue, our responsive customer support team is ready to provide the support you need. Our support services extend beyond troubleshooting – we’re here to guide you on optimising Mintyn to suit the evolving needs of your industry.

With a commitment to excellence, Mintyn ensures you are not just utilising a platform but building a partnership with a team invested in your success. Explore the comprehensive support services Mintyn offers and experience assistance beyond expectations.

Conclusion

Mintyn Banking as a Service(BaaS) and Embedded Finance are more than integration solutions. They are tools that can elevate your business operations. With various features that set us apart from competitors, Mintyn Solutions is ready to make your business expand. Ready to improve your business with Mintyn Financial Solutions? Contact Us