Get started and open a bank account online in just 1 minute! It’s only a click away! Mintyn offers the best online and digital banking experience there is! Mintyn offers you:

I. Convenience: 24/7 access. User-friendly mobile banking app. Fast and easy banking services.

II. Enhanced security: Two-factor authentication, biometrics verification, etc.

III. Lower Fees.

IV. 24/7 Customer support.

V. Competitive Interest rates.

VI. Innovative Features & Services: CoinBuddy, SpendMapster, ThriftyFly, Airtime2Cash, PayStream and so much more!

With technology, everything can be at your fingertips, including your bank! Get a feel of this new digital experience and explore its boundless possibilities. Mintyn is a world where convenience, speed and simplicity work harmoniously to meet your banking and financial needs.

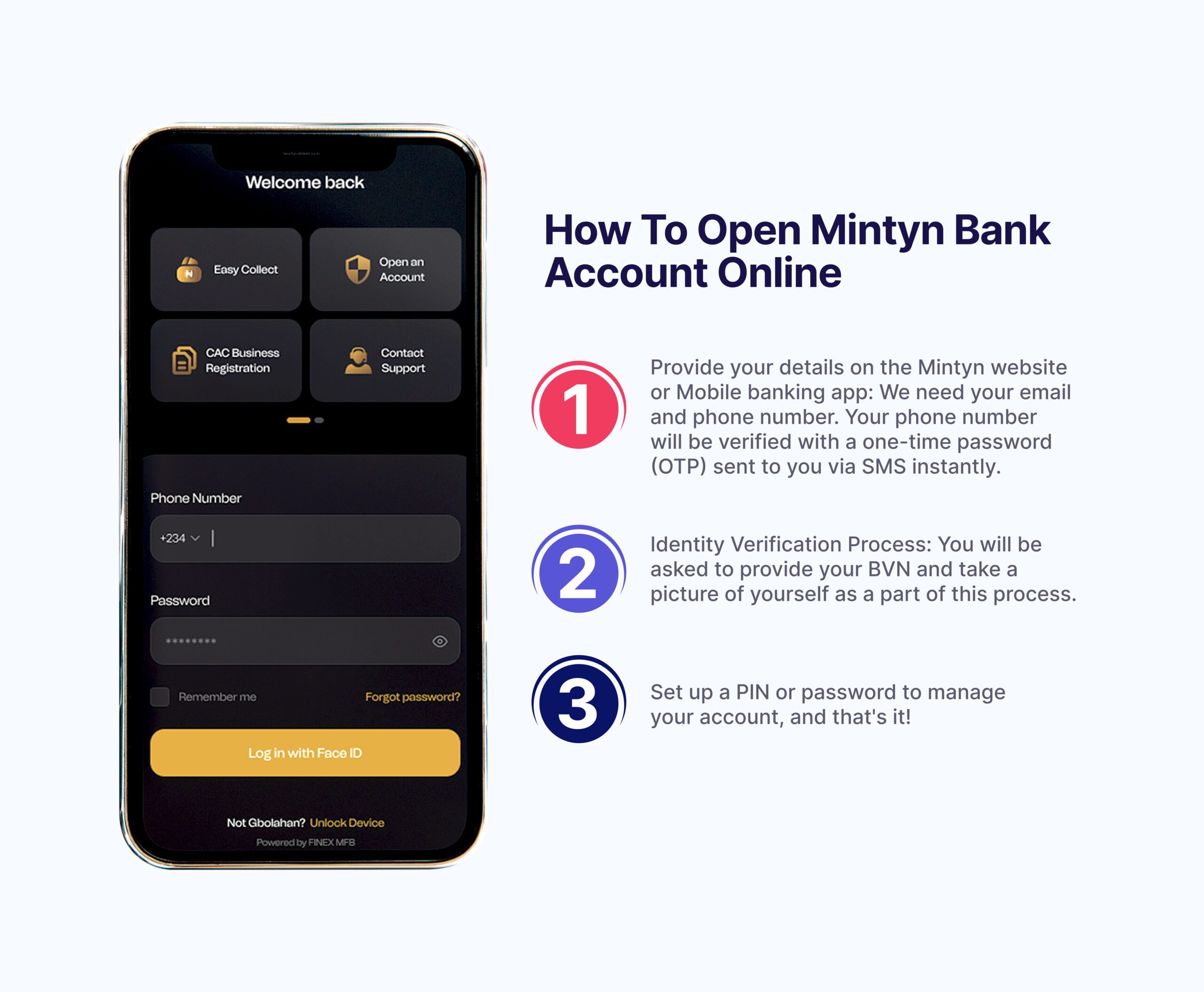

Getting Started: How to Open a Bank Account Online at Mintyn

Opening a Mintyn bank account online is very fast and easy. You can open a Mintyn bank account by following 3 quick and easy steps.

Steps: How to open a bank account online

1. Provide your details on the Mintyn website or mobile banking app. We’ll need your email and phone number; your phone number will be verified with a one-time password (OTP) sent to you via SMS instantly.

2. Identity Verification Process: You will be asked to provide your BVN and take a picture of yourself as a part of this process.

3. Set up a PIN or password to manage your account, and that’s it!

Requirements: What should you have?

1. An internet-enabled device; a smartphone is preferred.

2. An active phone number and email.

3. Your Bank Verification Number (BVN)

4. A valid government-issued form of identification: national ID card, driver’s licence, international passport, etc.

Providing Documents Digitally

Our digital-first approach ensures that you can provide the necessary documents digitally, making the process efficient and secure:

1. Scanning or Photographs: You can scan your documents or take high-quality photographs of them. Ensure that the images are clear and legible.

2. Secure Upload: Navigate to the document upload section on our website or mobile app. Follow the prompts to upload your documents securely

3. Verification Process: Our team will review the documents you submitted. You’ll receive email updates on your application status, so you’re always in the loop. By providing the required documents digitally, you save time and resources. It’s part of our commitment to delivering a hassle-free banking experience.

Best practices to ensure a hassle-free experience when you Open a Bank Account online.

Our process to open a bank account online is designed to be completely hassle-free. However, the following suggestions are made to ensure that you get the most out of this experience:

1. Ensure you have a stable internet connection.

2. Ensure you have all the valid documents and other requirements.

3. Ensure your environment is lit adequately while taking a picture of your face.

What Is the Best Bank Account for Me?

Choosing the right bank account can be as challenging as finding the perfect pair of shoes; it needs to fit you just right. Your financial journey begins with that one crucial decision. We can assist you in making this decision to choose the best bank account tailored to your unique needs. Here’s a list of our bank account offerings:

Savings Account

Are you in need of a simple and hassle-free way to save money? A Mintyn Savings Account offers easy access to your funds, competitive interest rates, and a low minimum balance requirement. It’s the ideal choice for those just starting to build their savings and those looking for more financially responsible use for spare income.

Current Account

The Mintyn Current Account is designed to meet the everyday banking needs of individuals and business owners. It allows expansive freedom and financial capabilities. This comes with relatively low maintenance fees, so you get the best value for your money with the Mintyn current account.

Business Bank Account

Entrepreneurs and business owners, your financial success starts here! Our Business Account is made to meet the unique banking needs of your company or business enterprise. We also have support features and resources for budding entrepreneurs, such as Corporate Affairs Commission (CAC) registration, tax advisory, quick business loans and other tailored financial tools to help you grow your business.

Diaspora Banking Account

At Mintyn, we understand that your financial needs extend beyond the shores of Nigeria. That’s why we’ve crafted the Disapora Banking Account , a bridge that connects you to international financial opportunities. Imagine having a bank account in the United States, Canada, or the United Kingdom – all from the comfort of your home in Nigeria!

How do digital banks work?

Digital banks function like traditional banks and do everything the traditional banks do; the only difference is banking and other financial services are delivered via the internet. The process of delivering these services is done through the deployment of advanced processes of automation and web-based services.

This allows interaction between multiple service providers behind the scenes to bring satisfactory financial services to the fingertips of the end user. In summary, as an end-to-end platform, digital banks allow interaction between the front-end users (bank customers) and back-end staff (bankers) with limited physical or one-on-one interaction between the two parties.

As this interaction is internet-based, it is accessible via mobile banking applications, online tools such as websites, automated teller machines (ATMs), and other forms of digital technology.

Therefore, all service delivery platforms in traditional banks, such as head offices, branch offices, debit/credit cards, ATMs, point-of-sale (POS) machines, etc., are available in digital banks, but in a more digitised, simplistic and convenient manner. Don’t get left out; join the digital banking revolution. Open a bank account online at Mintyn today!

Benefits of Opening a Bank Account Online with Mintyn

Here are some of the many benefits of opening a bank account online with Mintyn:

1. Convenience

Mintyn literally places the future of banking right in your palms. The convenience we offer is unmatched. Forget the hassle of travelling long distances and waiting in long lines to get proper banking services. Mintyn offers 24/7 access from anywhere in the world, complete card control, lightning-fast transactions, etc., and you don’t have to move an inch.

2. Lower fees

Mintyn has lower overhead costs when compared with traditional banks. This lets us offer much lower or no fees at all for various services like account maintenance, card maintenance, ATM withdrawals, and international financial transactions.

| Other Banks | Mintyn | |

| Transfer fees | 50 NGN + 7.5% VAT | Free for the first 20 transactions! |

| Card Delivery | Self Pick-Up | Free! |

| Card Maintenance Fee | 50 NGN Quarterly | Free! |

| Alerts | 4 NGN per SMS alert | Free! |

| Bill payment Charges | 100 NGN | Free! |

| Maintenance | 1 NGN per million | Free! |

Start enjoying these offers!

3.User-friendly mobile apps

Easy-to-use mobile applications provide a seamless banking experience. On the Mintyn mobile banking app, customers may gain access to all financial services on a 24/7 basis. No opening hours, no closing hours. The exciting thing about this is the freedom it also brings. It allows customers to do banking on their terms, however they prefer. It makes checking balances, managing debit/cards, transferring funds, paying bills, setting up alerts, and much more easy.

4. Enhanced security

Mintyn uses advanced security measures, such as two-factor authentication, end-to-end encryption, secure socket layer encryption (SSL), an automatic log-out function, SMS alerts/Push notifications on all activity, and biometrics verification. These help protect your financial information.

Two-factor authentication: is a 2-layer security system that requests two forms of identification from the user before they are allowed access to any kind of information, especially sensitive financial information.

End-to-end Encryption: is a private communication security system that ensures that only you (the user) and the bank can view any communication or request between the two parties. This means no third-party users may gain viewing access.

Secure Socket Layer (SSL) Encryption: Mintyn uses SSL to provide security on its web pages. You fill out very sensitive information on our web pages; we understand this and take it very seriously. Hence, our Uniform Resource Locators (URL) are SSL encrypted so that the URLs bear “https://” and not the regular “http://”. This is to assure you that whatever information you provide is safe and protected.

Biometric verification: Biometric verification is a security system that uses biometric information such as fingerprint identity and facial patterns to verify users. No two users can have the same biometric data, especially fingerprint biometrics. Hence, we have integrated this essential security feature for identity verification in our mobile applications.

Auto-logout function: This security function logs a user out of the system after a period of inactivity is observed. This prevents unauthorised access to the user’s financial information.

SMS alerts/Push Notifications: These alerts and prompts appear across all your registered devices to give you real-time updates about any activity on your account.

Enjoy maximum security for your money and financial information when you open a bank account online with Mintyn!

5. Competitive interest rates

Mintyn offers one of the best and most competitive interest rates on our various account classes (Savings accounts, Current accounts, Business accounts and Diaspora Banking accounts) as well as with our various investment plans (Flex Pro, Flex Plus, Flex Elite, Yield Max Pro, Yield Max Plus and Yield Max Elite)

| Account Classes | Interest Rates | ||

| Savings Account | 9% – 18% | ||

| Current Account | 9% – 18% | ||

| Business Account | 9% – 18% | ||

| Investment Plans | Maturity Period | Interest Rate | Fees for Early Withdrawals |

| Flex Plus | 1- 3 months | 9% p.a. | 0.0% |

| Flex Pro | 4 – 6 months | 10% p.a. | 22.0% |

| Flex Elite | 7 – 9 months | 13% p.a. | 38.5% |

| Yield Max Pro | 10 – 12 months | 16% p.a. | 50.0% |

| Yield Max Plus | 13 – 24 months | 18% p.a. | 55.5% |

Grow your money and savings with Mintyn as your trusted partner.

6. Innovative Products and Features

We want to be more than just a bank to you. We care and would like to be your trusted financial companion. Hence, we have created unique products and services to help you best use your financial resources.

Our extra products and services include:

CoinBuddy is a budgeting tool by Mintyn that lets you gain complete control of your finances. You are saying goodbye to overspending and hello to financial freedom! CoinBuddy puts you in the driver’s seat, allowing you to track every naira you spend, set realistic goals, and stay accountable. Our app’s user-friendly design and robust features will help you take charge of your wallet and be financially independent!

SpendMapster is our easy-to-use feature that lets you know where every naira goes. It is easily linked to your cards so that it instantly records your spending as it occurs.

Airtime2Cash will let you sell your airtime balance for money anytime and anywhere! If you’ve mistakenly typed a few zeros while topping up your airtime balance and need your cash back, don’t worry; we’ve got you!

Paystream makes managing your payments to several accounts as easy as a few taps on your screen. PayStream provides a convenient means for business owners to run automated payroll systems. Tired of the tedious process of making multiple payments to different accounts individually? Say goodbye to that hassle and hello to convenience with our new app feature.

ThriftyFly helps you find and book wallet-friendly flights. Our goal is to help you maximise the use of your financial resources. You can trust that we will deliver on this. To start enjoying these exclusive products and services, open a bank account online with Mintyn today!

Open a Bank Account Online with Mintyn- The Environmentally Friendly Bank

A Mintyn bank account is where the future of banking meets environmental responsibility. Embracing digital banking goes beyond the convenience of managing your finances; it’s a step towards a greener, more sustainable future. Mintyn contributes to environmental responsibility by reducing paper usage and minimising your carbon footprint. Be environmentally responsible! Open a Mintyn bank account today!

Environmental Responsibility

Reduced Paper Usage

In our commitment to environmental responsibility, we’ve significantly reduced the need for paper in your financial transactions. Traditional banking often involves countless sheets of paper for statements, receipts, and documentation.

In contrast, Mintyn offers a paperless approach that helps conserve valuable resources. By opting for our digital bank account, you play a part in reducing paper production, ultimately saving trees and minimising the environmental impact of paper manufacturing. Say goodbye to physical statements and hello to the convenience of accessing your financial information digitally.

Minimised Carbon Footprint

Every action counts in combating climate change. Traditional banking practices, with their reliance on paper and needing customers to commute to bank branches, have a considerable carbon footprint. In contrast, digital banking is a game-changer in minimising this impact.

When you choose our current account, you choose a bank that cares about the environment. By conducting your financial transactions online, you reduce the need to travel to physical branches, which means fewer cars on the road, less fuel consumption, and reduced greenhouse gas emissions. In other words, it’s not just your financial burden that gets lighter; it’s the environmental burden as well!

How Does Mintyn Make a Difference?

Paperless Statements: Access your account statements, transaction histories, and documents digitally. No more cluttered file cabinets or stacks of paper. Our digital platform lets you securely view, download, and store your financial records.

E-statements: Receive your account statements through secure electronic delivery. Not only do you get quick access to your financial information, but you also help save trees and reduce paper waste.

Online Banking Tools: Our online banking tools, like checking balances and reviewing transactions, promote a greener banking experience. With these features, you can manage your finances efficiently without needing printed documents.

Reduced Travel: With our mobile app and online banking, you can conduct your banking activities from the comfort of your home. There’s no need for frequent visits to a physical branch, cutting down on your carbon emissions and contributing to a cleaner environment. Join Us in Making a Difference! Start banking with Mintyn today!

We’re Always Here For You- 24/7 Customer Service and Support

Your peace of mind becomes our priority after you open a bank account online with us! We don’t just want to be your bank; we want to be a financial partner that provides you round-the-clock support! If you have a question, need help with a transaction, or want to resolve an issue, our dedicated customer support team is just a call or email away! Anytime and Anywhere!

Testimonials

SomtoChukwu

“This bank is the most convenient, user-friendly, and swift bank I have ever experienced in the financial space. It takes me less than a second to log in and consummate my transactions. I’m glad I came across a banking app like Mintyn that bridges my financial transaction needs to be tailored to my lifestyle. Well done, Mintyn, for your extraordinary service”

Asido

“During these difficult times when cash is scarce, Mintyn Bank has proven to be the ideal choice for me when it comes to transfers. The speed is incredibly fast, and payments are received by the recipient faster than ever. Additionally, I love shopping on the Mintyn Marketplace due to the attractive price discounts. Using the Mintyn app is truly amazing”.

Dencillion

“It’s a kind of app and online bank I prefer mostly because it has no stress at all. It is very good and calm to save money, keep it up Mintyn!”

Karen King

“Wait, why didn’t anybody tell me about this @Mintynapp since? So this is what you people have been enjoying? Transferring money without any transfer fee? Nawa oh, I thought we all agreed to help each other.”

Mohammed Ibrahim

“Beautiful app with very good support service. Keep it up!”

Samora I. Fortune

“Guys @Mintynapp is not just a bank. They also offer premium financial services. With MINTYN BANK you can draft your monthly budget, you can view a proper statistics of your income and expenses.”