Looking for a quick fix for unexpected financial challenges? Explore the world of hassle-free payday loans to access quick funds and solve your financial needs before your next pay day.

What is a payday loan?

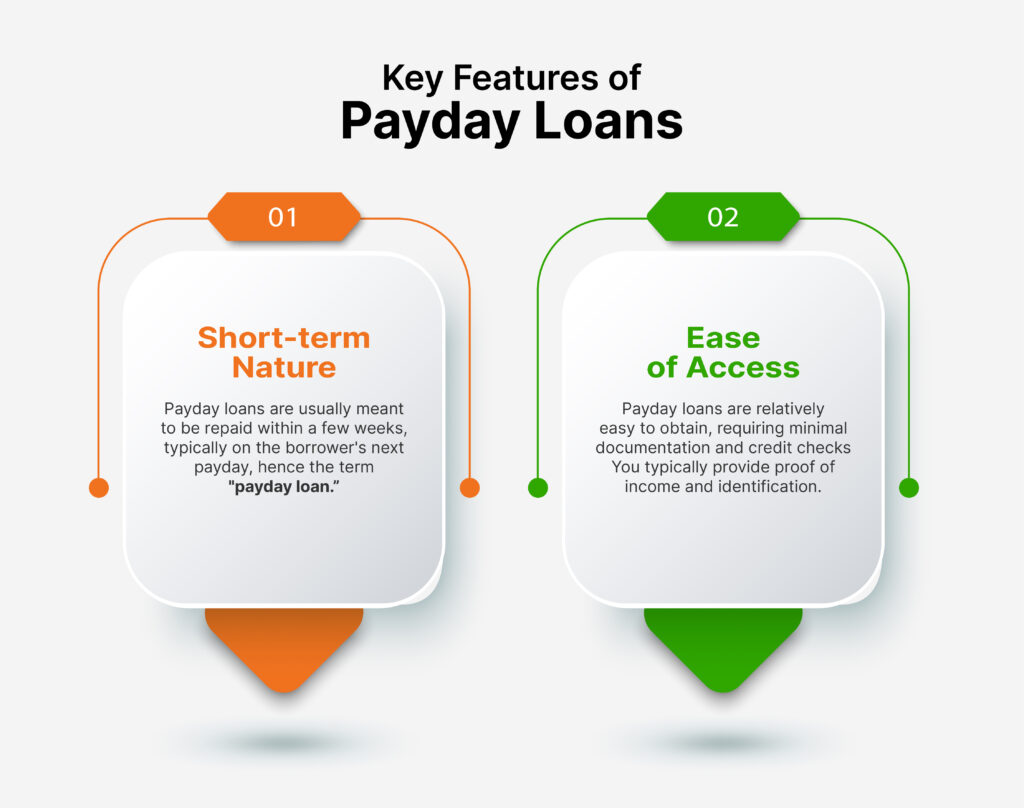

A payday loan is a short-term, high-interest loan typically designed to cover immediate expenses until your next payday. These loans are often sought after by individuals facing urgent financial needs and require quick access to cash. Payday loans streamline access to funds for employees facing unforeseen expenses or financial emergencies between pay periods.

How do payday loans work?

Payday loans provide swift access to small sums, typically due on the borrower’s next payday. Moreover, applicants, often grappling with poor credit, need to submit minimal information for rapid approval. Upon approval, the borrower repays the agreed-upon loan, including fees, through a post-dated check or electronic debit on the specified date.

However, extensions come with additional fees. In light of this, financial experts advise caution. They stress the importance of comprehending terms and exploring alternatives, as the consensus views payday loans as an expensive and risky solution. There’s a potential to trap individuals in a recurring pattern of borrowing, making it crucial to weigh the options carefully.

How to get a payday loan

To secure a payday loan, find a lender—online or in-person—and submit a simple application with proof of income, identification, and a bank account. Eligibility criteria are typically minimal. Upon approval, review the loan terms, including the amount, fees, and repayment date. Provide a post-dated check or authorize electronic debiting for repayment. Once approved, funds are swiftly deposited into your account.

However, exercise caution due to high costs and potential debt cycles associated with payday loans. Before proceeding, explore alternative options and ensure a thorough understanding of the terms to make an informed financial decision.

Who is eligible for payday loans?

Eligibility for a payday loan typically involves having a regular income, verified through pay stubs or bank statements. Identity verification requires a valid government-issued ID, and applicants often need a checking account for fund deposit and electronic repayment. Proof of residency, like a utility bill, may be necessary. Most lenders mandate applicants to be at least 18 years old.

While payday lenders may not conduct traditional credit checks, creditworthiness is often assessed through other means. Meeting these criteria doesn’t guarantee approval, and responsible borrowing entails understanding the total cost and ensuring timely repayment. Specific eligibility requirements vary among lenders.

When to apply for a payday loan

Apply for a payday loan only in genuine financial emergencies when quick cash is imperative. Exhaust alternative options first, like seeking help from friends, family, or negotiating with creditors. If unavoidable, carefully understand the payday loan terms, including fees and repayment conditions. Assess your financial capability to ensure timely repayment, preventing additional charges and a potential cycle of debt.

Remember, payday loans are costly and not a sustainable solution. Avoid regular reliance on them, prioritizing more affordable borrowing options and financial planning to maintain long-term financial stability. Use payday loans cautiously, understanding their implications, and consider professional financial advice if needed.

Are payday loans secured or unsecured loan?

Payday loans are typically unsecured loans. In an unsecured loan, borrowers are not required to provide collateral to secure the loan. Instead, the lender relies on the borrower’s income and creditworthiness to assess the risk of lending. For payday loans, the borrower usually provides a post-dated check or grants the lender electronic access to their bank account to secure repayment.

The unsecured nature of payday loans contributes to their accessibility, as borrowers are not required to pledge assets, such as a car or house, as security. However, it’s important to note that the lack of collateral also results in higher interest rates and fees to compensate for the increased risk for the lender.

Eligibility criteria for payday loans

1. Employment Status

As an applicant, you must demonstrate a stable income source. Typically, this involves being employed, receiving regular paychecks, or maintaining a consistent income stream.

2. Identification and Verification

You need to provide valid identification documents when applying for a payday loan, usually a government-issued ID such as a driver’s license, passport, or state ID. This is necessary to confirm your identity and fulfill the eligibility requirements.

3. Active Bank Account

You need to have an active bank account to make it easier for the loan disbursal and repayment processes. This account information is crucial for directly receiving the loan amount and setting up repayment arrangements afterward.

Click here to open an account.

4. Meeting Minimum Age Requirement

As an applicant, you must be at least 18 years old to apply for a loan.

5. Residency and Legal Status

You need to be a legal resident or citizen of Nigeria.

6. Compliance with Loan Policies

You have to comply with all loan policies and lending guidelines, which might involve particular terms and conditions regarding borrowing limits, repayment schedules, and interest rates.

Click here to learn more about payday loans.