As a business owner in Nigeria, the thought of opening a business bank account has probably crossed your mind once or twice. Having an account in your business name comes with certain advantages. For one, it speaks to your level of professionalism.

It gives your customers the impression that you are legitimate and dedicated to your business. Other advantages include quicker access to loans and more efficient error-free taxation.

But getting a business bank account is often challenging. This is because opening a business account requires very specific documentation.

In this friendly guide, we’ll walk you through two of the most confusing paperwork requirements. They are the Corporate Affairs Commission (CAC) registration and obtaining a Tax Identification Number (TIN)

Let’s dive in!

Simplifying Business Account Documentation: CAC Registration and TIN

Your CAC and tax documents are about the two most important documents necessary to open a business bank account in Nigeria. The processes for obtaining them may seem complex, but we’ve simplified them here for you.

How To Register Your Business With The CAC

As we stated earlier, a CAC registration gives your business a touch of legitimacy and indeed communicates dedication.

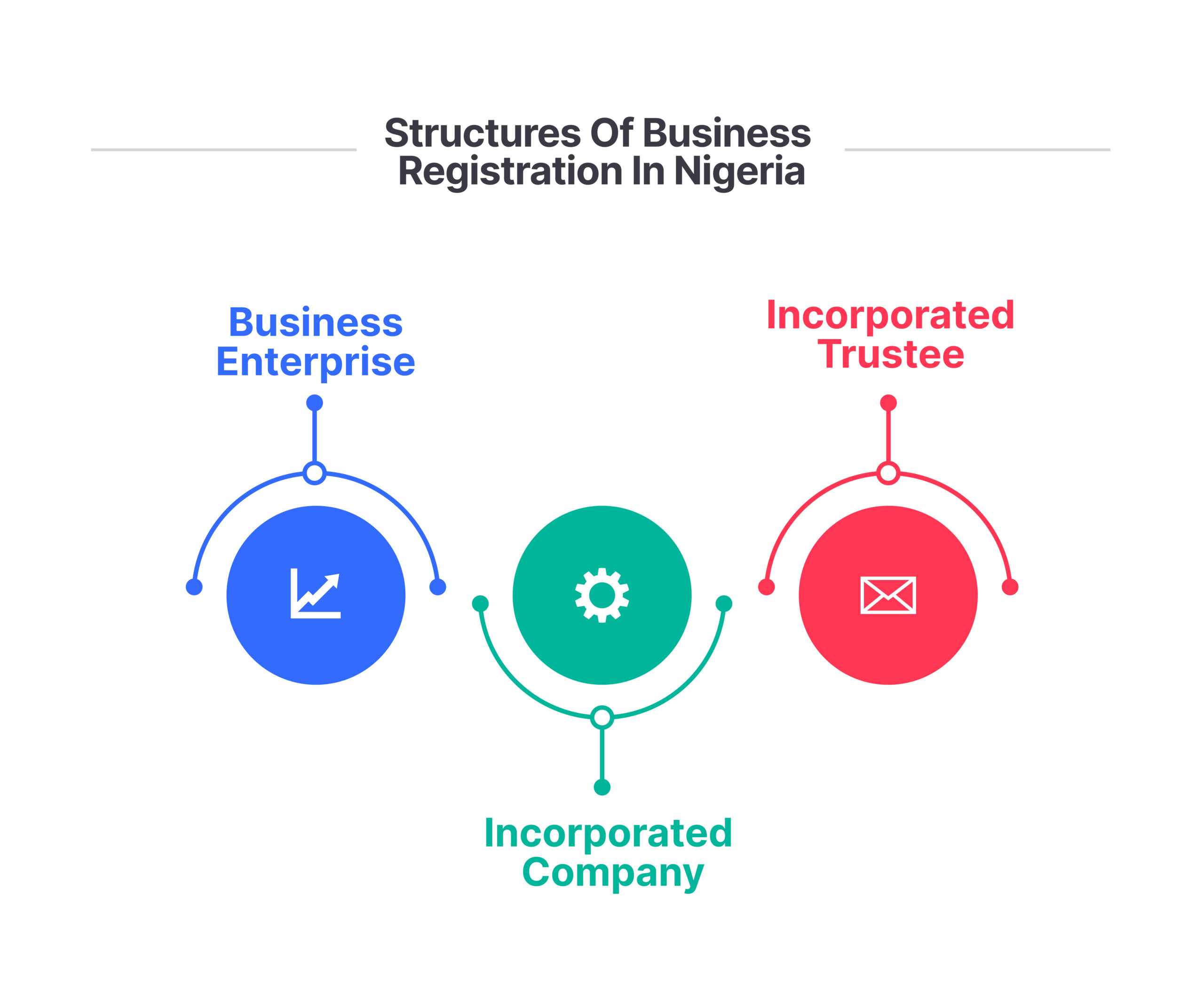

In general, there are 3 structures under which you may register a business in Nigeria:

1. Business Enterprise

2. Incorporated Company

3. Incorporated Trustee

How to Register a Business Enterprise

This applies to a partnership or sole proprietorship business venture. The good thing is this process can be done online on the CAC website without any issues.

You’ll need the following documents to register your business name successfully. It’s important to have them ready before you begin to ensure there’s no interruption.

1. Valid Identification

You’ll need a government-issued ID. Any of the following will be suitable:

-International Passport

-Voter’s Card

-NIN (National Identification Number) Slip or Digital NIN Slip

-National ID Card

-Driver’s License

Make sure your identification documents are valid and that the documents state your credentials correctly.

2. Passport Photograph

Use a clear and clean passport photograph. A white background is advisable to avoid any complications. Avoid heavy makeup or facial accessories like hats, caps or eyeglasses. Ensure the photograph captures all aspects of your face.

3. Signature Image

Get a scanned copy of your signature on a plain white sheet or transparent background. You can use a good PDF Sign and Fill mobile application to create this.

This signature will be crucial for online documentation. Ensure every aspect of your signature is visible without any ambiguity.

After getting these documents, you can get right into registering your business name. Follow these easy steps:

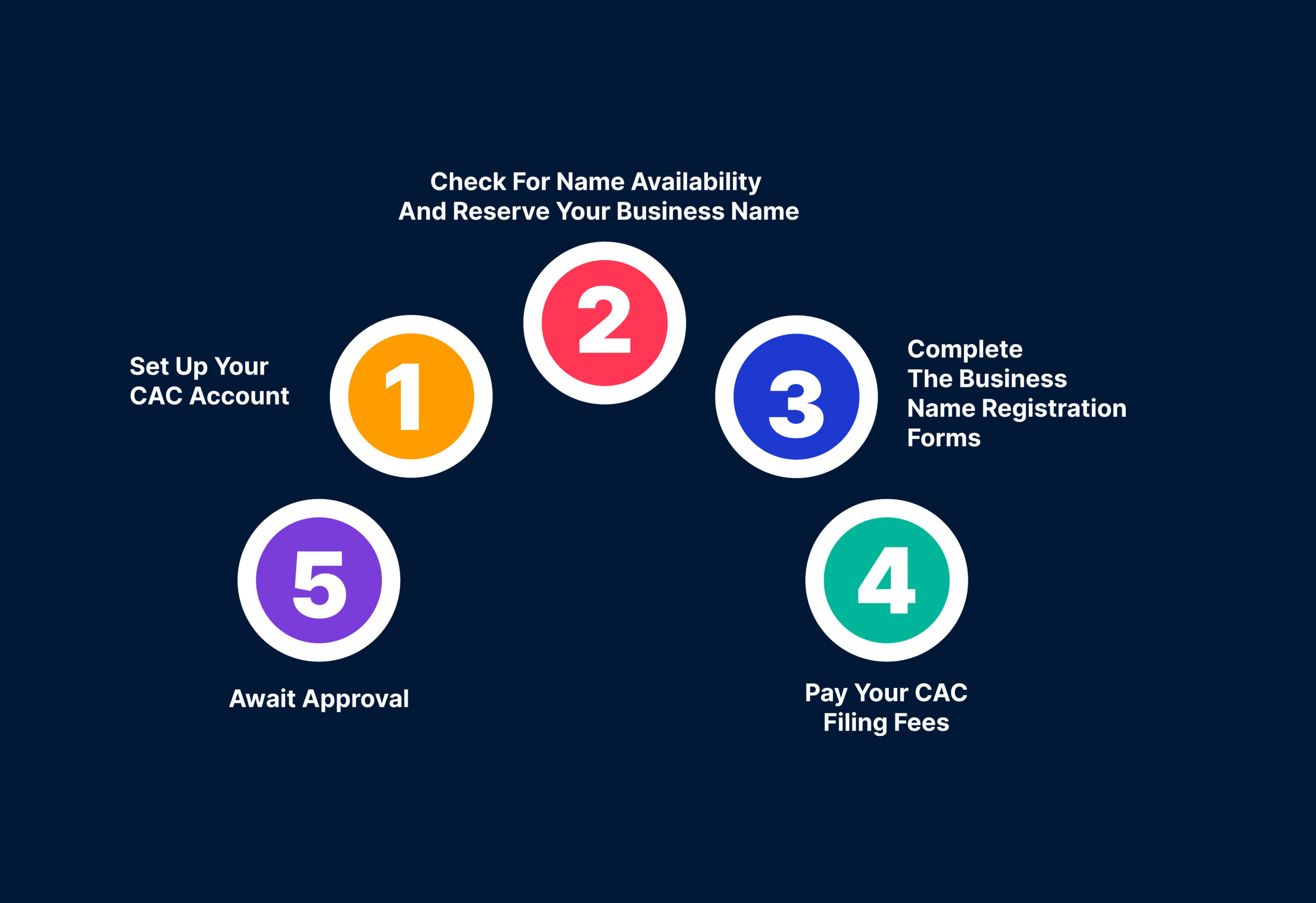

1. Set Up Your CAC Account

Begin by creating your CAC account. Use your mobile phone number or NIN. It’s a quick and easy process.

2. Check for Name Availability and Reserve Your Business Name

With your login details, sign in and head to the CAC name reservation page. Here, you can check if your desired business name is available.

If you get a green light on the name availability, you may then reserve your name for a 60-day period at a fee. Be sure to complete the registration within this timeframe.

3. Complete the Business Name Registration Forms

Fill in the business name registration forms with all the necessary and precise information. Accuracy is key!

4. Pay Your CAC Filing Fees

It’s time to handle the financial aspect. Pay your CAC filing fees conveniently online. Refer to CAC’s schedule of fees for a detailed guide on the payment process.

5. Await Approval

Once you’ve paid your fees, patiently wait for CAC’s approval. Check their schedule for more information on fees. Once approved, you can submit your forms. CAC will review your documentation and notify you of the successful approval.

Your business name certificate will be ready for collection. Congratulations! Your business name is now officially registered with CAC. You should note, however, that registering a business enterprise is not the same as registering a company. It also does not confer your business with a separate legal entity status in the eyes of the law.

How to Register an Incorporated Company

Under Nigerian law, a company is defined as a business with a separate legal entity status. This means that the business is seen as an entity separate and distinct from the owners of the business. Companies in Nigeria may be either Private or Public companies.

The Company and Allied Matters Act (CAMA) is the law that governs and regulates the activities of companies in Nigeria. This act makes it compulsory to register your company, at most, within 28 days of commencing operations.

Here are the steps to register your company:

1. Reserve Your Business Name

The initial step in the company registration process in Nigeria involves a name availability search. It’s crucial to ensure that the name you have in mind for your company is unique and not already in use.

Once you’ve decided on your desired name and confirmed its availability, you may proceed to reserve it. Name reservation is allowed for 60 days. Do the availability check and reservation on the name reservation page.

2. Register Shareholder Details

In accordance with Nigerian law, a private company must have a minimum of 2 members and cannot exceed 50 members. For a public company, a minimum of 2 persons is required. You’ll need to provide information such as the shareholders’ names, residential addresses, occupations, email addresses, and mobile phone numbers.

Additionally, a recognised identity document, such as an international passport, driver’s license, or national identity card, is required.

3. Get the necessary documentation

The documents necessary for company registration include the following:

-Memorandum and Articles of Association.

-Notice of the registered business address.

-Particulars of the Directors.

-Statement of compliance by a Lawyer.

4. Payment, Submission, and Collection

After making the required payments online (the amount depending on your company’s share capital), upload all the documents to finalise your submission. The CAC will contact you in case of any queries. If there are none, they’ll notify you when the registration is complete. You can then visit their office to collect your certificate of incorporation.

How To Register an Incorporated Trustee

Incorporated trustees are non-profit organisations run by an association or a group of people. Incorporated trustees may include religious organisations such as churches and mosques as well as other organisations like unions, charities, and non-governmental organisations (NGOs).

The CAC is empowered under CAMA to register incorporated trustees. Here are the steps you must follow for an incorporated trustee registration:

1. Create an account using your NIN or phone number.

2. Check for name availability and reserve your incorporated trustee name.

3. Complete the registration forms: Provide all the required information and ensure you have all the necessary documents.

Here’s a list of documents and required information you would need to provide:

Association’s Identity and Documentation

-The name and official letterhead of the association.

-A comprehensive constitution outlining the principles and guidelines of the association.

-Clearly defined aims and objectives of the intended Incorporated Trustee association.

1. Association’s Details:

-The physical address of the association.

-Names of the proposed trustees, with a minimum requirement of at least two or more individuals.

-The residential addresses of each trustee.

-Occupations of each trustee.

2. Trustee Tenure and Governance:

-Specifics on the tenure of each trustee.

-Procedures for the removal and filling of trustee vacancies.

3. Executive Members and Roles:

-A detailed list of executive members, encompassing positions like president, auditors, secretary/treasurer, and others as applicable.

4. Supporting Documentation:

-A copy of the required newspaper advertisement publications essential for the association’s registration.

-A copy of the minutes of meetings where the appointment of trustees took place.

Ensuring that all these elements are accurately compiled and presented will contribute to a smooth and successful registration process for the association.

How to Obtain Your Tax Identification Number (TIN)

After completing your CAC registration, the next task will be obtaining your tax identification number. The good news is that tax payments in Nigeria have been made easy through government initiatives that automate the process.

A noteworthy update from the Corporate Affairs Commission (CAC) in 2020 reveals that Tax Identification Numbers (TINs) are now included on CAC certificates for incorporated companies. This means if you registered your limited liability company in 2020 or later than 2020, your TIN is conveniently located at the bottom of your CAC certificate.

However, there are two avenues for application for business owners who registered their companies before 2020 and haven’t secured a TIN. What are these avenues? You can either visit any Federal Inland Revenue Service (FIRS) office or apply online through the Joint Tax Board.

For business enterprises, that is, business entities that are not incorporated companies, TINs are not automatically included on their certificates. To obtain a TIN, you must visit a tax office or apply online through the Joint Tax Board.

Requirements for TIN Application in Nigeria

Whether you’re applying at an FIRS office or online, specific details are required for a successful TIN application:

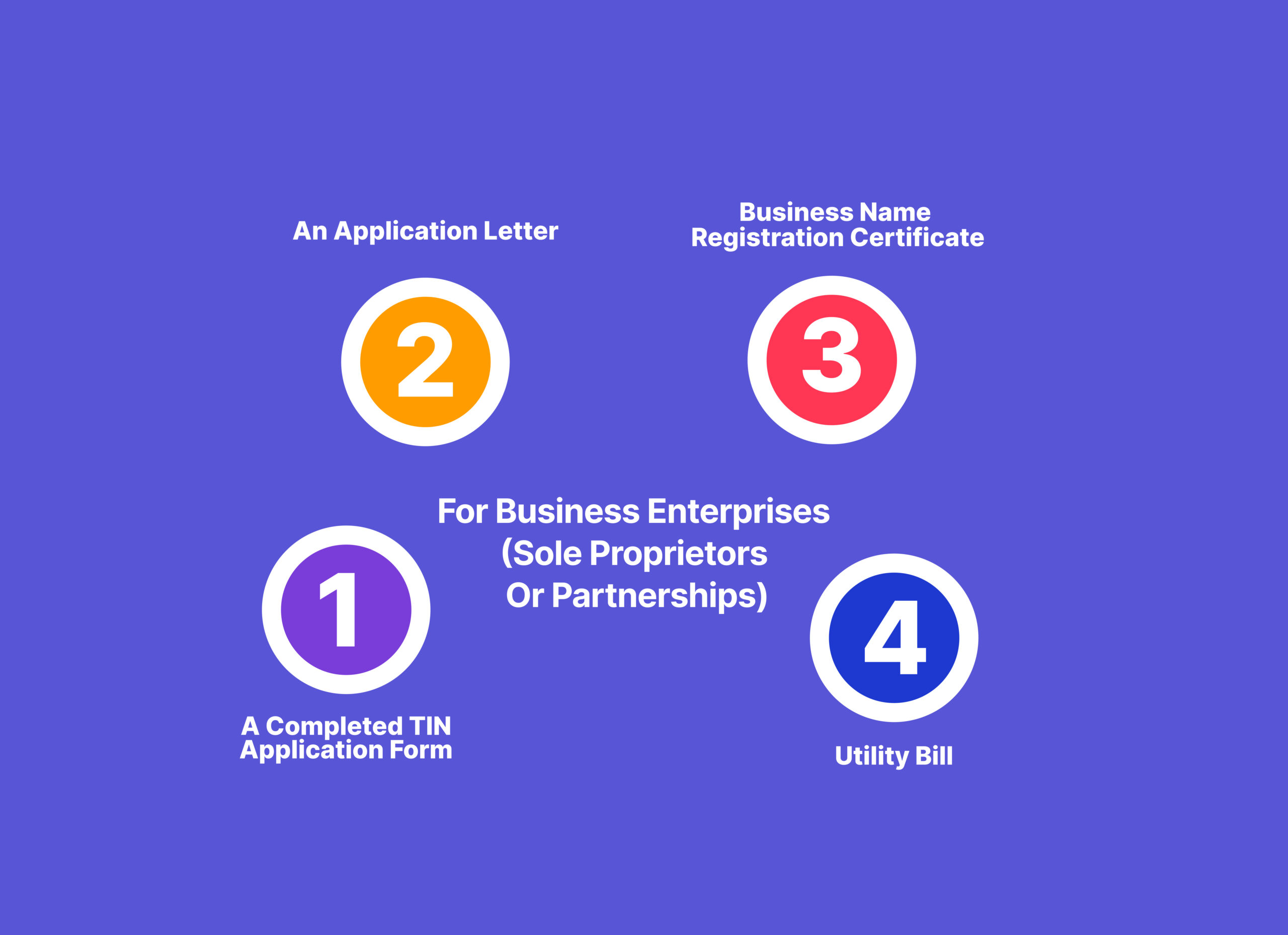

1. For Business Enterprises (Sole Proprietors or Partnerships)

-A completed TIN Application Form.

-An application letter,

-Business Name Registration Certificate.

-Utility bill.

2. For Incorporated Companies

-Duly completed TIN Application Form.

-Memorandum & Articles of Association (MEMART).

-Certificate of Incorporation.

-Particulars of the Company Directors.

-Statement of Share Capital.

-Utility bill.

Having these details on hand will facilitate a smooth TIN application process, whether done in person at an FIRS office or through the online platform.

Outsourcing Your CAC and Tax Registration For Your Business Account

Now, you understand all the processes and steps involved in doing your CAC registration and obtaining your TIN. That’s great, but what if we told you there’s an easier and more convenient way to do it that would be completely stress-free?

Yes, you could outsource the whole process. Let someone handle it for you while you focus on other important things. But to do this, you’ll need a trusted and reliable service provider like Mintyn. Mintyn is one of Nigeria’s fast-growing digital banks.

Mintyn offers fast and easy CAC registration and TIN application services, so you do not have to bother about all the intricacies of the registration processes. Once the registration hurdle is out of the way, then sign up for a Mintyn Business Account With this business account, you can enjoy all the resources and support features that are tailor-made for business owners.

Benefits of Outsourcing Your CAC and Tax Registration For Your Business Account

Let’s talk about the general benefits of outsourcing:

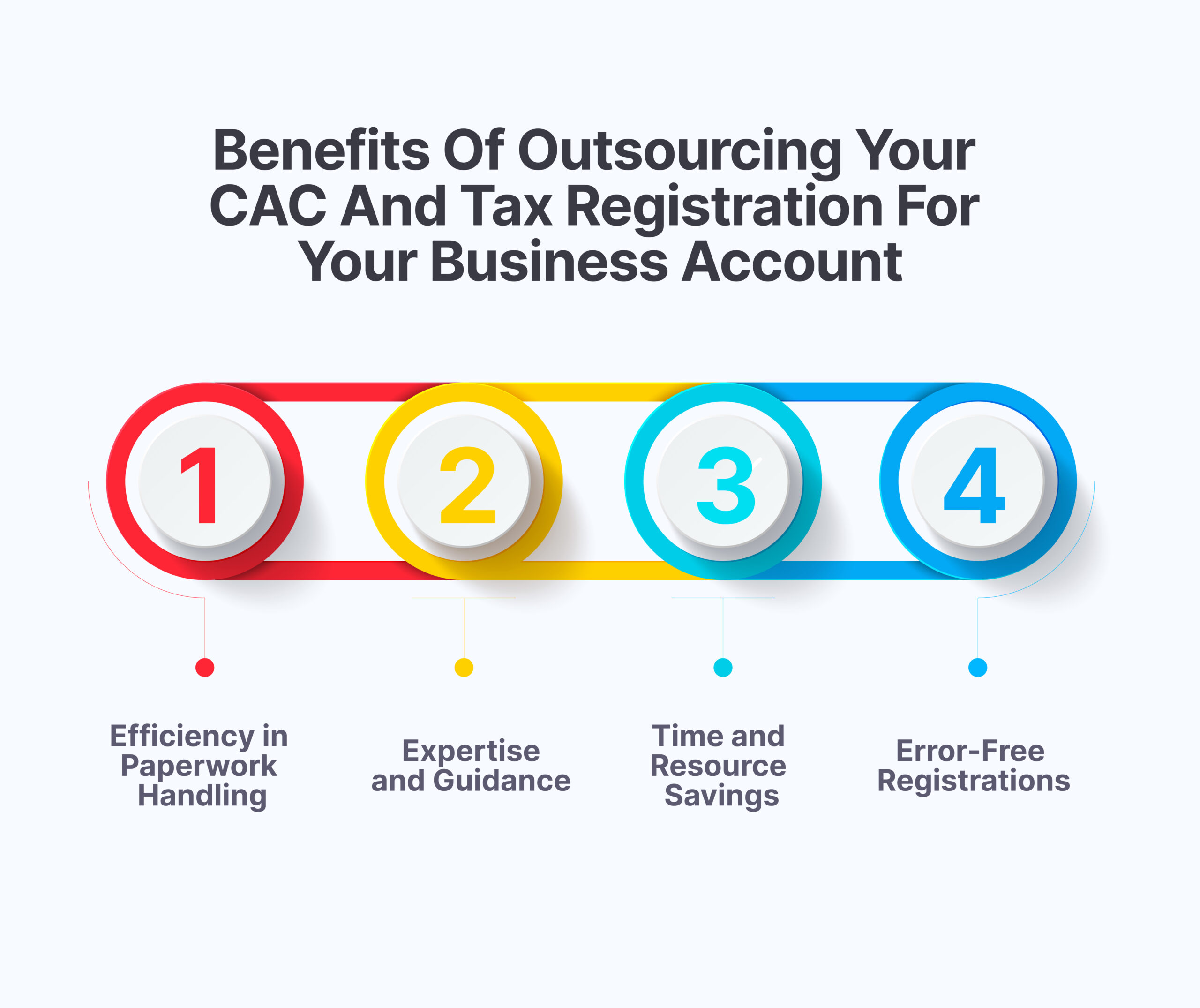

1. Efficiency in Paperwork Handling

Outsourcing your CAC and Tax Registration takes the paperwork load off your shoulders. Professionals handle the documentation, ensuring accuracy and compliance, leaving you more time for core business activities.

2. Expertise and Guidance

Professional service providers bring expertise to the table. With their guidance, you navigate through the complexities of the registration process effortlessly, minimising the chances of errors and delays.

3. Time and Resource Savings

Outsourcing these administrative tasks saves valuable time. This allows you to redirect your energy towards strategic business decisions and operations, promoting overall efficiency.

4. Error-Free Registrations

Outsourcing ensures meticulous attention to detail. Professionals are well-versed in the intricacies of registrations, minimising the risk of mistakes that could lead to complications down the line. Outsourcing your CAC and Tax Registration is a strategic move that not only streamlines your business processes but also lets you benefit from the expertise of professionals in the field.

Final Thoughts

When opening a business account, documentation hurdles may feel like a mountain to climb. Still, with the right guidance and resources, you’ll overcome the challenges and set your business on a path to success. Remember, outsourcing the documentation processes is a very convenient option.

Digital banks like Mintyn can help simplify your entrepreneurial journey. Mintyn goes from streamlining your CAC and TIN registrations to offering a seamless Business Bank Account, Mintyn stands with you at every step.

Happy business banking!

Leave a Reply